Which? recommended providers include First Direct, Starling Bank, Nationwide Building Society, and M&S Bank.

Every year, Which?, a UK website that offers independent advice on purchase of goods and services and raises awareness of consumer rights, surveys thousands of current account customers and asks them to rate the service they receive. This gives it the Which? Customer Score.

The website then calculates the ‘product score’ of almost 40 current accounts to find Which? Recommended Providers – the banks and building societies that offer great products and top-notch customer service.

Ten elements of the banks’ service are evaluated: overall customer service; the application process; regularity and clarity of communication; transparency of charges; dealing with complaints and resolving problems; service in branch; telephone, online and mobile banking; and benefits such as cashback and credit interest.

The most recent top list of Which? Recommended Providers includes First Direct, Starling Bank, Nationwide Building Society, and M&S Bank, all with a customer score over 70% and an above-average product score, based on the conducted analysis of their standard current accounts.

The following rating depicts the UK best and worst banks, according to Which? Money:

| No. | Provider | Which? Customer Score | Product Score |

| 1. | First Direct | 84% | 76% |

| 2. | Starling Bank | 83% | 58% |

| 3. | Monzo Bank | 82% | 62% |

| 4. | Nationwide BS | 78% | 60% |

| 5. | M&S Bank | 76% | 64% |

| 6. | Metro Bank | 75% | 47% |

| 7. | The Co-operative Bank | 73% | 51% |

| 8. | Barclays Bank | 70% | 62% |

| 9. | Halifax | 70% | 56% |

| 10. | Santander | 70% | 60% |

| 11. | Lloyds Bank | 69% | 69% |

| 12. | NatWest | 69% | 64% |

| 13. | Yorkshire Bank | 69% | 67% |

| 14. | Danske Bank | 66% | 63% |

| 15. | HSBC | 66% | 51% |

| 16. | TSB | 65% | 53% |

| 17. | Bank of Scotland | 64% | 60% |

| 18. | Clydesdale Bank | 64% | 60% |

| 19. | Royal Bank of Scotland | 62% | 64% |

| 20. | Tesco Bank | 60% | 65% |

| 21. | Ulster Bank | 55% | 60% |

Source: Which? Money

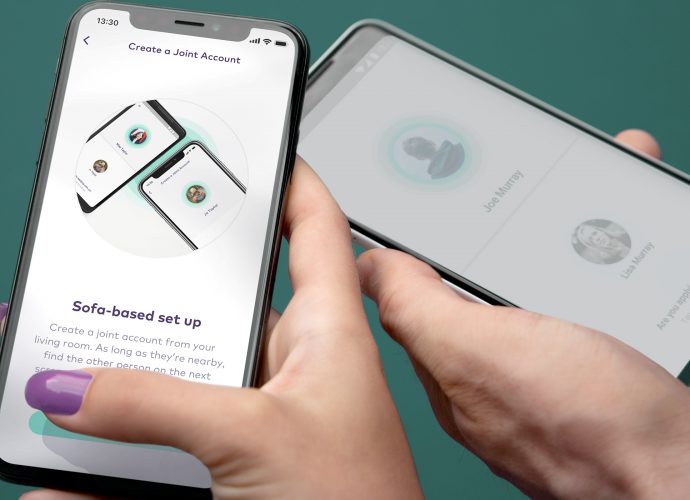

Neither First Direct nor Starling Bank has a presence on the high street (although First Direct can use branches of parent bank HSBC for basic transactions) so customers must use online banking or, in the case of Starling, a smartphone banking app to manage their accounts.

However, the choice of Nationwide Building Society and M&S Bank as the final Which? Recommended Providers suggests that many people still value traditional face-to-face banking, particularly when digital services fail.

Which? is no longer formally recommending banks that aren’t signed up to the ‘Authorised Push Payment Scam Code’ which launched on 28 May 2019. Several major banks are yet to sign up to the voluntary code, including Monzo, although it told Which? that it’s planning to sign up by March 2020.

As Which? explains, the APP code forces banks to better protect their customers from bank transfer scams – where a criminal tricks you into sending money to their bank account – and reimburse them if they fall short of these standards. If banks are blameless, victims should still be reimbursed from a communal pool, although the long-term funding for this is still being decided.

Image: Starling Bank

Thanks!

Our editors are notified.