Blockchain technology can be implemented in many ways, depending on the objective.

Blockchain is a massive public ledger of every user activity across its extensive network. The ledger itself is public but the data on the blockchain are verified and encrypted by advanced cryptographic methods which, alongside the absence of third parties, minimise the risk of a hack. Originally intended as a baseline protocol for financial transactions only, today’s blockchain infrastructure is permeating every industry.

Although the technology is still new for most of us without the engineering background, its application in business is already very promising as it helps significantly reduce administrative costs. First of all, businesses that usually engage in many types of transactions every day can save on the cost of verification and on the cost of networking.

MIT Sloan Assistant Professor Christian Catalini believes that the greater speed, security, disclosure and privacy of blockchain can disrupt many industries:

- central banks (lower settlement risk, more efficient taxation, faster cross-border payments, inter-bank payments, and novel approaches to quantitative easing)

- finance (low cost, secure, verifiable international payments and settlement)

- money transfer (global peer-to-peer transactions through payment platforms)

- micropayments (crowdsourcing and cross-platform subscriptions for on-demand services)

- smart contracts (where information recorded on a blockchain can be used by self-executing contracts)

- provenance and ownership (where details recorded about physical products can help verify authenticity and prevent fraud and counterfeiting)

- Internet of Things (IoT), robotics and artificial intelligence (where smart technologies will be able to barter or acquire resources, verify identity or accept payments)

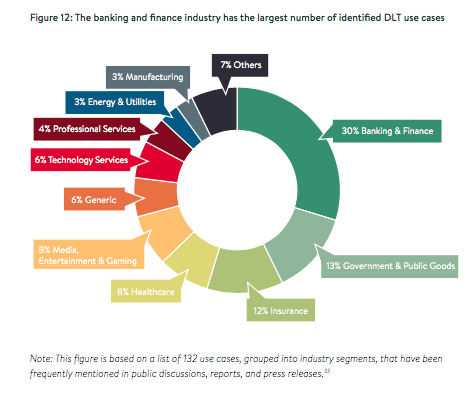

A report by the Cambridge Centre for Alternative Finance (CCAF) identified that the number of startups that offer enterprise Distributed Ledger Technology (DLT) solutions has tripled since 2014, from 37 to at least 115 in 2017. Data from more than 200 central banks, corporations, startups and other public sector institutions showed that the banking and finance industry has the largest number (30%) of DLT use cases:

Samantha Radocchia, Co-Founder of Chronicled, says that blockchain and the IoT are laying the groundwork for the digital economy that will automate all business processes in the near future. Blockchain will be used as a trusted and interoperable backend to power automated supply chain processes that other systems can plug into.

Small and medium-sized businesses can take advantage of the new self-reliant data infrastructure to scale business operations and process payments. Blockchain can be used to create, check and enforce smart contracts between merchants, clients and customers. Inoicing, paying bills, payrolls, inventory management, dealmaking and any other transactions between users can be done with the help of smart contracts. Ledger entries will make these agreements irrefutable and universally enforceable.

Blockchain identity tools will help companies handle huge amounts of personal data. Blockchain cryptographic standards ensure that customers are verified automatically. Users can have access to certified documents and notaries, while customers can safely purchase services and products in the marketplace.

Better access to funds necessary for the company’s growth should not be underestimated either. Fundraising through initial coin offerings (ICOs) has become much easier and quicker in a distributed ecosystem based on blockchains. The ICO sphere is currently undergoing high regulatory scrutiny, but when legislation for the crypto-related industry is eventually introduced, it will make the access to financing even easier.

Thanks!

Our editors are notified.