The UK’s “alternative finance” industry has grown by 43% over the last year to £4.6 billion.

According to the latest report by the Cambridge Centre for Alternative Finance, alternative finance has grown hugely in the UK over the last decade. A number of startups, ranging from peer-to-peer lenders like Funding Circle and Zopa to crowdfunding services like Crowdcube and Seedrs, form part of Britain’s booming fintech industry.

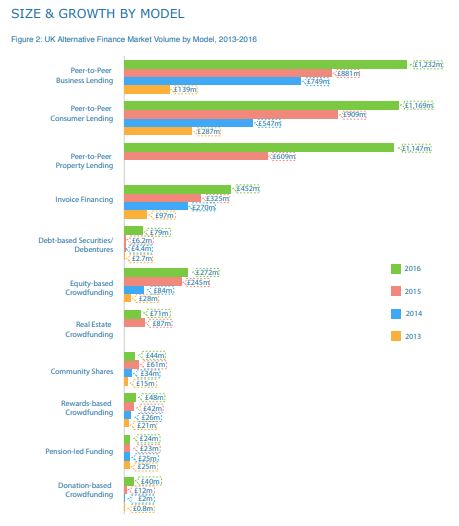

The fourth UK Alternative Finance Industry Report published by the Cambridge University’s Judge Business School outlined the following £4.6 billion “altfi” sector break down:

- Peer-to-peer business lending: £1.23 billion

- Peer-to-peer consumer lending: £1.17 billion

- Peer-to-peer property lending: £1.15 billion

- Invoice trading: £452 million

- Equity crowdfunding: £272 million

- Property crowdfunding: £71 million

- Reward-based crowdfunding: £48 million

The five largest alternative finance platforms account now for 64% of total market volume.

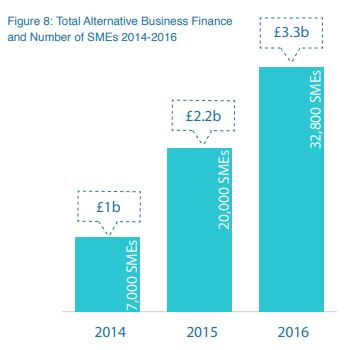

Approximately 72% of all alternative finance market volume, or £3.3 billion in total, was raised for UK startups and small businesses. This was a £1.1 billion (50%) increase on the £2.2 billion of business finance raised in 2015. The report said that 33,000 firms used alternative finance in 2016, compared with 20,000 in 2015.

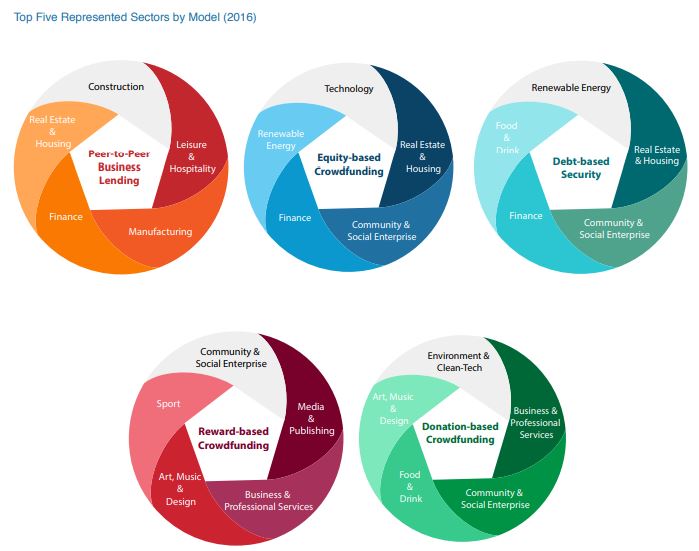

Finance and Real Estate & Housing are well represented sectors across the alternative finance ecosystem, and represent one of the top five sectors for Peer-to-Peer Business Lending, Equity-based Crowdfunding and Debt-based Securities. Construction and Manufacturing were both industries well

represented by Peer-to-Peer Lending platforms, whilst the most funded sectors for Equity-based Crowdfunding were Technology and Renewable Energies, respectively. Community & Social Enterprise was the highest funded sector for both Donation-based and Reward-based Crowdfunding.

As pointed out by Bryan Zhang, Executive Director of the Cambridge Centre for Alternative Finance, “with equity-based crowdfunding now accounting for 17% of all seed and venture stage equity investment in the UK, and peer-to-peer business lending providing an equivalent of 15% of all new loans lent to small businesses by UK banks, alternative finance has entered the mainstream and is likely here to stay.”

Image: Nattanan Kanchanaprat

Thanks!

Our editors are notified.