Most Brits are unaware of which illnesses they should tell insurers about when buying travel insurance.

A recent Which? investigation found that travellers often failed to disclose information about their health to insurers, facing punitive premiums when they suffered ailments.

As a rule, insurers require that you disclose some illnesses and injuries before taking out an insurance policy. According to Medical Travel Compared, the following medical conditions must be disclosed before purchase:

- Type 2 Diabetes – if you received treatment or diagnosis within two years

- Diagnosed current pregnancy complications – relevant if you are pregnant and are suffering complications

- Epilepsy – if a seizure resulted in a visit to medical practitioner or treatment within the last two years

- Asthma – if you have ever suffered from any diagnosed respiratory condition

- Parkinson’s Disease – if you have been diagnosed or treated for early onset Parkinson’s within two years

- Arthritis – if you have received diagnosis or treatment within two years for any diagnosed medical condition

- High blood pressure – if you have ever suffered from any diagnosed circulatory condition

- Post-traumatic stress disorder and depression – if you have ever suffered from diagnosed psychiatric or psychological conditions

- Irritable Bowel Disease – if you have received diagnosis or treatment within two years for any diagnosed medical condition

- Cancer – if you have ever suffered from any diagnosed cancerous conditions

Many people believe they only need to disclose illnesses if they’re currently taking medication for them or if they have suffered from them within two years. However, some serious conditions, such as heart, respiratory illnesses, cancer and depression, must be disclosed to insurers regardless of how long ago you stopped receiving treatment.

If you have ever been seriously ill or suffer from chronic conditions, then getting insured for holidays or finding an affordable deal can be extremely challenging. The Medical Travel Compared survey revealed that a third of people with a pre-existing condition said it was difficult to obtain travel insurance, while the same portion also found the costs too high after declaring previous illness or disease.

Using price comparison websites can help you shop around for quotes, but Which? advises to avoid choosing a policy solely based on price. Once you agree to the terms of a policy, making a travel insurance claim will be impossible in relation to health conditions that are excluded.

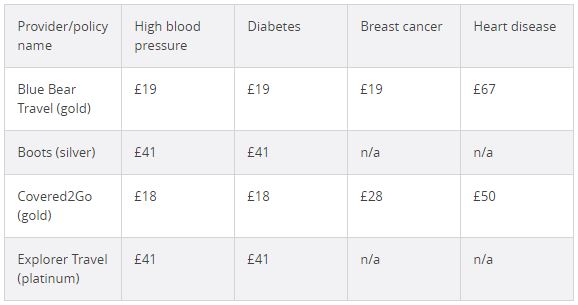

The following specialist providers have been selected by Which? for the best value single-trip cover for people with serious pre-existing medical conditions:

Image: Vysoké Tatry, Slovakia / Nina Uhlíková

Thanks!

Our editors are notified.